Important

We’ve sent you an email with all the important details. Please check your inbox (or spam/junk folder) after you finish reading this page.

The 5 Step Process To Check Your Super With Confidence.

1)Expert Matching

Based on your enquiry, you are matched with a pre-vetted adviser.

2) Quick Call

Your adviser will reach out with a quick, no-pressure call to discuss your enquiry, confirm details, and answer any questions you may have. If they identify ways to assist, they’ll help you schedule a follow-up to complete the comparison.

3) The Fact Finding Process.

During this call, your adviser will explore your superannuation goals and preferences in detail. You’ll have the chance to review your fund’s performance and discuss other key areas such as insurance, tax structuring, beneficiaries, salary sacrificing, debt management, and investment strategies.

4) Outcome | No Obligation Advice

Based on your unique needs and situation, your adviser will provide an in-depth superannuation comparison and offer tailored recommendations designed to align with your financial goals and priorities.

5) Share Feedback, Possibly Win A Holiday

Want your chance to take your family on a holiday? Follow the instructions below to enter the competition and possibly take your win a 5 ⭐ Holiday!

Real Super Comparisons from Our Trusted Partners

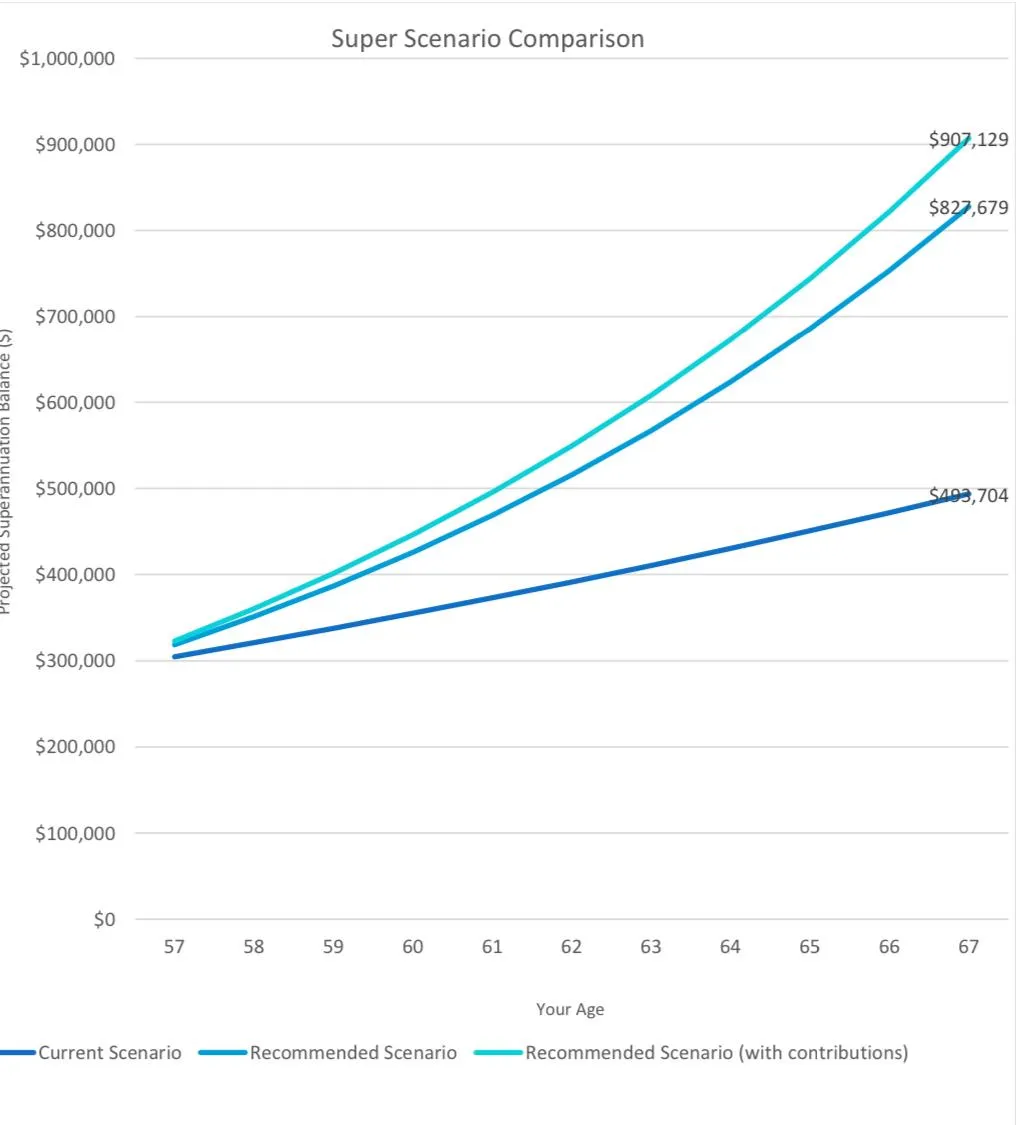

Superannuation And Debt Strategy

With the recommended super strategy and adjusting contributions appropriate to disposable income, the client's projected to increase wealth, reduce debt and shorten loan term by 5 years.

10 yr Projected Outcome

$413,425 in extra wealth at retirement

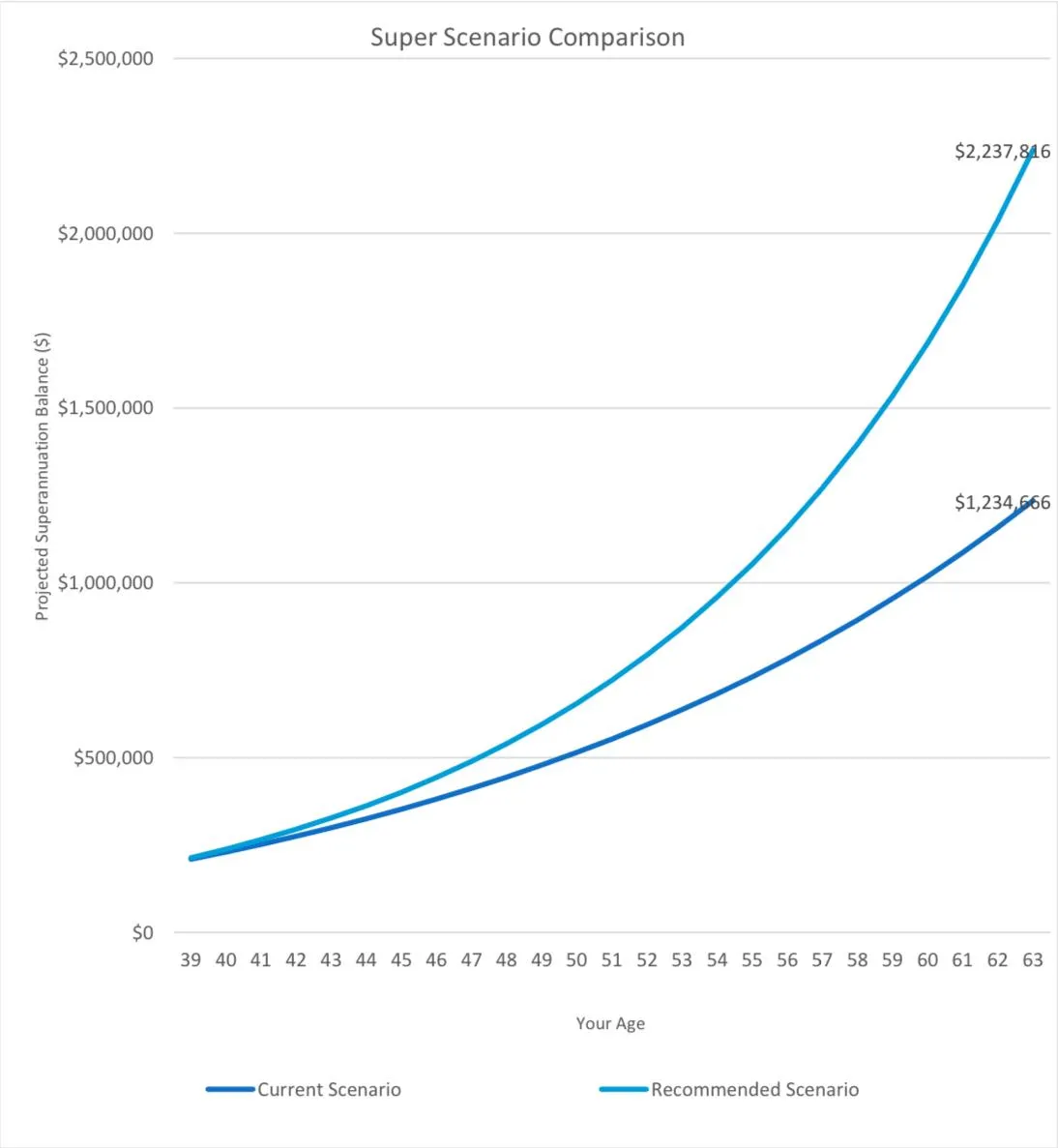

Maximising Contributions

With early advice, this client is projected to grow their retirement savings by an additional $1,205,078 by age 60. By setting aside $100 per week, they're on track to save $29,469 in 5 years, helping them reach their goal of purchasing a family home.

Solution

$1,205,078 in extra wealth

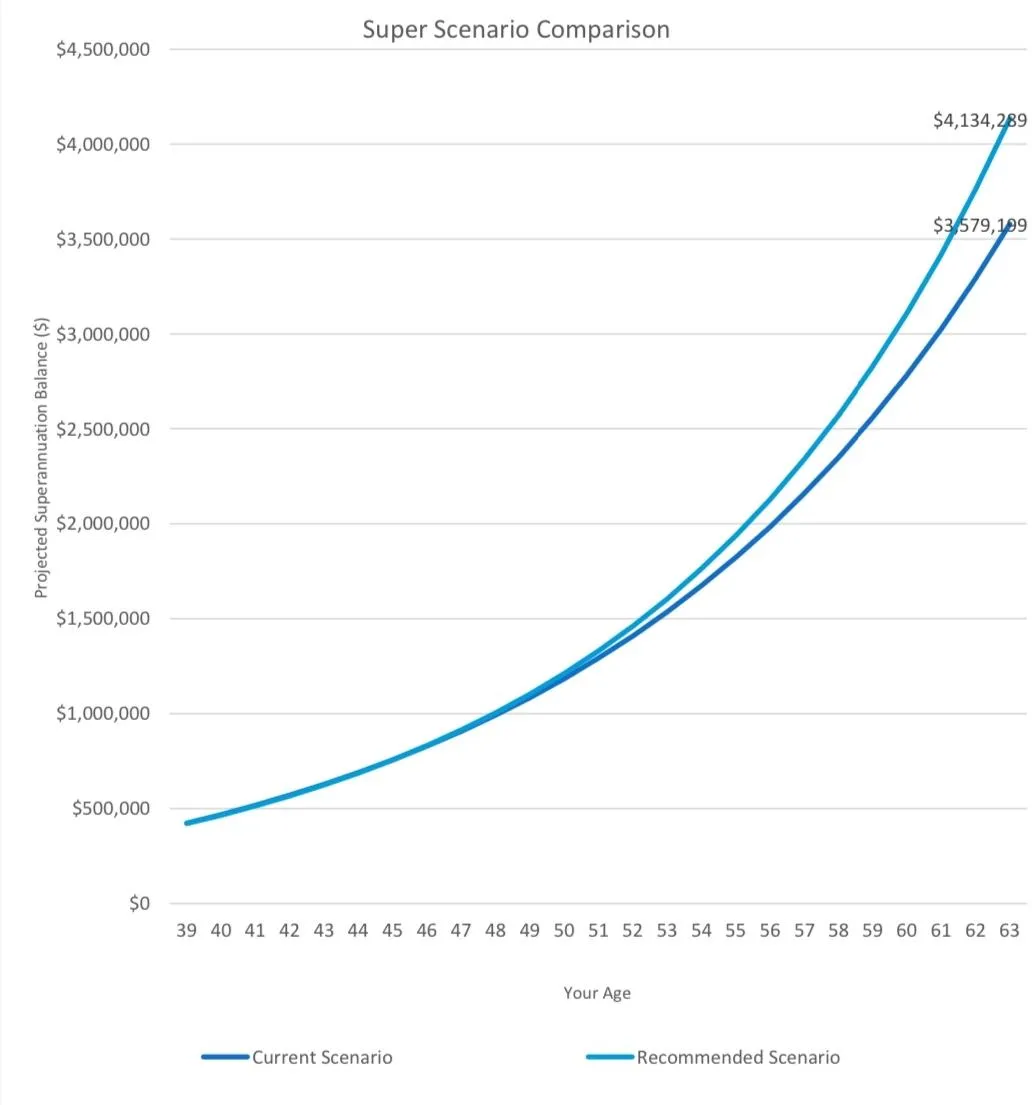

Comparison Outcome

By implementing the recommended superannuation strategy, the adviser's client is projected to increase their retirement savings by an estimated $702,998, helping them maximise wealth and secure a stronger financial future.

Projected outcome

$702,998 in extra wealth

Super Comparison Australia's Mission

At Super Comparison Australia, we know that thousands of Australians risk losing out on significant super savings simply by not planning early. Too many people are stuck in underperforming funds or missing out on expert strategies that could boost their super’s growth—potentially costing them six or even seven figures over a lifetime.

Our mission is to connect Australians with trusted financial advisers who provide valuable insights into superannuation and financial options. By planning early, you can secure a better retirement. We bridge the gap by referring you to qualified, licensed experts who can guide you through the complexities of superannuation, helping you make informed financial decisions—without any obligations.

The Risks of Inaction in Superannuation

Many Australians overlook the importance of reviewing their superannuation regularly, and this oversight can have significant long-term consequences. According to studies, more than 50% of Australians don’t actively manage their superannuation, resulting in lost opportunities for growth and potential fees they may not be aware of. This can impact your retirement outcomes, leaving people with less than expected when they reach retirement age.

Not comparing super funds, can leave your retirements investments in underperforming funds, or failing to understand the fees you’re paying can add up significantly over time. For example, ASFA estimates that Australians could be losing thousands of dollars simply by not comparing their super fund's performance or fees.

Why Early Action is Key

Taking action early by understanding your superannuation options can make a significant difference over time. Many Australians assume they only need to focus on their super closer to retirement, but that’s not the case. Your super can grow significantly over time, and small changes now could lead to substantial benefits down the track.

That’s where Super Comparison Australia steps in. We connect you with financial advisers who are licensed to offer advice and can help provide clarity around the options available to you without the pressure or obligation. Whether it’s exploring different funds, understanding how your current fund is performing, or ensuring you’re making the most of available benefits, having the right information can help you make more informed decisions.

Common Financial Pitfalls to Avoid

Many Australians fall into common traps when it comes to their superannuation, such as leaving their savings in an underperforming fund or paying higher fees than necessary. This is why financial experts say it is important to regularly review your superannuation. With the right information from experts, you can better understand where your super stands and take steps to avoid potential pitfalls, such as excessive fees or missed financial opportunities that your super fund won't explain.

Our trusted partners are licensed professionals who can help you navigate the complexities of the super system, ensuring you have the knowledge to make informed decisions about your financial future. It’s all about giving you the tools and insights to manage your super more effectively.

ASIC Recommendations

According to the Australian Securities and Investments Commission (ASIC), it's important to seek independent financial advice to ensure you're getting the most appropriate solutions for your circumstances. Super Comparison Australia aligns with this principle by connecting you with pre-vetted, licensed financial advisers who provide tailored insights, helping you navigate your superannuation with confidence.

Our trusted advisory firms have helped thousands of Australians avoid costly financial mistakes and gain clarity on decisions that create a lasting, positive impact on their financial future.

Projected $326,414 better off in retirement

Projected $667,088 better off in retirement

Projected $413,425 better off in retirement

As a special incentive, when you complete your no obligation superannuation comparison and share your honest feedback with our customer experience team, you’ll be entered into a competition to WIN a family holiday voucher valued at $999, including 3 nights at a 5 ⭐ hotel! Your honest feedback helps us improve our service and impact more Australians for better financial futures.

Want your chance to win a holiday? After you finish your comparison with your adviser, simply email your honest feedback to [email protected], and you'll be automatically entered into the competition.

Frequently Asked Questions

Why should I review my superannuation in 2024-2025?

Reviewing your super in 2024 -2025 is essential to maximise growth, stay compliant with new regulations, and adapt to market changes. It could help you avoid underperforming funds, reduce fees, and ensure your strategy fits your life changes, all while optimising for tax benefits. Stay on track for a secure retirement!

How do I know if I'm making the best moves with my super?

You may think your super is on track, but without expert guidance, you could be missing key opportunities. Speaking with a licensed expert is crucial to ensure your strategy is optimised, fees are minimised, and your retirement goals are fully aligned.

How often should I review my superannuation?

It's generally recommended to review your superannuation at least once a year. The Australian Taxation Office (ATO) advises checking your super regularly to ensure you're on top of your contributions, minimising fees, and staying aligned with changes in superannuation laws. Additionally, financial experts, like those from ASIC's Moneysmart, suggest reviewing your super when major life changes occur, such as switching jobs, getting a raise, or when market conditions change. Regular reviews with a licensed expert can help optimise your strategy for long-term growth and retirement security.

What happens during a superannuation comparison?

During a superannuation comparison, your fund's performance, fees, and investment strategy are assessed to ensure they align with your unique goals. Contributions and insurance are also reviewed. Additionally a licensed expert can provide personalised advice, along with insights to maximise financial success—without any obligation.

Will I need to change my super fund?

Not necessarily. A superannuation comparison may reveal that your current fund is performing well and suits your goals. However, if there are better-performing funds with lower fees or more suitable investment options, a licensed expert might recommend switching to maximise your returns. Ultimately, the choice is yours, and there’s no obligation to change.

Super Comparison Australia Disclaimer and Terms

Super Comparison Australia is not a superannuation fund or a financial advisory firm. We function as a referral service, directing inquiries made through our website to licensed partners who provide relevant products and services. We may receive referral fees or commissions from third-party companies for these introductions. While we aim to cover a broad range of products and services, we do not cover every option available in the market. In some cases, our selection of partners may be limited due to your specific circumstances or because we have agreements with only certain providers. By clicking "SUBMIT," you acknowledge that you will proceed with a product or service through a referral from SuperComparisonAustralia.com.au

After submission, you will be dealing directly with the third-party companies and their representatives, rather than with SuperComparisonAustralia.com.au By providing your details, you agree to receive communications, including calls and emails, from the third-party providers or their representatives using the contact information you supplied. Super Comparison Australia does not provide comparisons between superannuation funds or performance reviews of your super fund. We do not provide financial advice, issue financial products, or make claims to do so.

While we strive to ensure the information on our website and in subsequent communications is accurate, we cannot guarantee the accuracy of third-party or contributor information. You accept full responsibility for the use of any material on this website, which is not intended to replace professional financial advice. You should not rely on this information for financial or investment decisions. We strongly advise you to seek professional advice that takes into account your individual financial objectives, situation, and needs before making any decisions. By submitting your details on this site, you agree to our: